Blinkit Launches 10-Minute Ambulance in Gurugram: Zomato Latest Innovation

Zomato Limited: Overview

Zomato Limited, which was founded in 2010, is among the top online meal service platforms based on the quantity of food supplied. Among its features are meal delivery, dining-out options, loyalty plans, and more. As of December 31, 2020, Zomato had a significant footprint throughout 23 countries, with 131,233 active food delivery restaurants, 161,637 active delivery partners, and an average monthly food order of 10.7 million clients. It has three brands under its name Zomato, Hyperpure and Blinkit. The revenue contribution of Zomato is Food delivery 70%, Quick Commerce 24% and Going out is 6%. Zomato has active listed restaurants of 390,000 and clients are 16.4 mn monthly. Zomato is working in 1000+ cities and about 500 cities are added in FY22. The company has 28 subsidiaries, 1 trust and 1 associate.

Latest Stock News (04-Jan-2025)

Zomato‘s subsidiary has launched 10 min ambulance in Gurugram, this initiative has covered many eyes on internet. Blinkit is planning to expand this initiative to other major cities which can benefit the Zomato’s image among its customers. Hemal Jain has resigned from her Senior Management Personnel role from Zomato. Zomato has faced a GST charge of ₹401 crore with a penalty. This GST penalty was on the GST collected on the delivery charges.

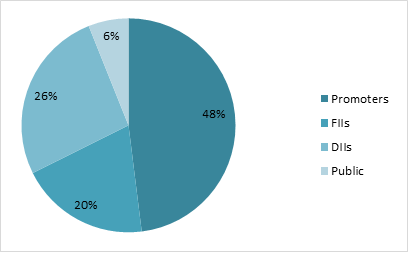

Shareholding Pattern as on September 2024

Key Stats

| Market Cap | ₹263309 Crore |

| Revenue | ₹15855 Crore |

| Profit | ₹742 Crore |

| ROCE | 1.14% |

| P/E | 355 |

Peer Comparison

| Amt in ₹ Cr | MCap | Sales | PAT | ROCE | Asset Turn. | EV/EBITDA | D/E | P/E |

| Zomato | 263309 | 1588 | 742 | 1.14% | 0.54 | 183 | 0.05 | 355 |

| Swiggy | 121200 | 11247 | -2304 | -68.8 | 1.03 | -67 | 0.15 | – |

| Info Edge | 116956 | 2663 | 485 | 3.65 | 0.1 | 89.6 | 0.01 | 245 |

| FSN E-Commerce | 47985 | 7077 | 42.9 | 6.87% | 2.01 | 117 | 1 | 1121 |

| One 97 | 62641 | 8278 | -2013 | -8.5% | 0.57 | -46.9 | 0.01 | – |

Financial Trends

| Amount in ₹ Cr | 2020 | 2021 | 2022 | 2023 | 2024 |

| Revenue | 2605 | 1994 | 4192 | 7079 | 12114 |

| Expenses | 4909 | 2461 | 6043 | 8289 | 12071 |

| EBITDA | -2305 | -467 | -1851 | -1211 | 43 |

| OPM | -88% | -23% | -44% | -17% | 0% |

| Other Income | 16 | -200 | 793 | 682 | 846 |

| Net Profit | -2386 | -816 | -1222 | -971 | 351 |

| NPM | -91.6% | -40.9% | -29.2% | -13.7% | 2.9% |

| EPS | -70096 | -23126 | -1.54 | -1.14 | 0.4 |

Stock Price Analysis

Zomato has shown a return of -4.27% in one day, -2.55% over the past month, and 1.45% in the last three months. The stock has experienced fluctuations today, with a low of ₹271.7 and a high of ₹285.65. Over the past 52 weeks, the shares have seen a low of ₹121.7 and a high of ₹304.5. The stock price is in upward range and volumes traded have normalized from the past. Stock has given 6 times returns in 2 years showing the support from great financials of company.